Standard Chartered Singapore Clarifies SWIFTBIC Code Usage

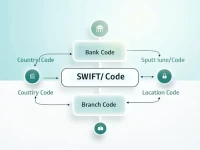

Understanding the SWIFT/BIC code SCBLSG22EQI for STANDARD CHARTERED BANK (Singapore) is crucial for ensuring safe and efficient international remittances. This article discusses the structure of SWIFT codes, key usage points, and the multiple advantages of choosing Xe for remittances, including better exchange rates, transparent fees, and fast transfer services.